The World,

Tailored to You.

Dubai, United Arab Emirates

We Invest Where It Matters

How We Use the MSCI ACWI Index as a Global Compass

The MSCI ACWI Index gives us a comprehensive view of the global investment landscape. It helps us understand where economic power lives and which companies matter most — across 23 developed and 24 emerging markets. But we don’t stop at the index itself.

Developed

Emerging

Instead of owning the index directly and accepting all of its imperfections, we use it as a guide to build smarter, more customized portfolios. Here's how:

-

We start by mirroring the country weightings of the index to ensure global diversification.

-

Within each country, we research and select the top-performing, most liquid, and most relevant companies — skipping the rest.

-

Many small-cap companies add noise without adding value. We focus on the names that actually move markets.

-

Every client owns a separately managed portfolio, allowing us to make adjustments based on their tax situation, preferences, and goals.

What We Own

We invest in companies — not just concepts.

There are many ways to participate in the growth of a business: bonds, private equity, partnerships — even loyalty as a customer. But our philosophy is simple: we believe in owning the companies themselves through equities. Stocks offer a time-tested combination of growth, liquidity, and transparency that makes them the most powerful wealth-building vehicle in modern history. That’s why our portfolios are built with direct ownership of companies through individual stocks and ETFs.

Historical Rates of Return per Asset Class

Equities have consistently outperformed nearly every other asset class over long time horizons. While fixed income or alternatives may have a role in certain environments, stocks are the heartbeat of wealth creation.

—

-

U.S. equities have outpaced bonds, real estate, and commodities by a wide margin, even through wars, recessions, and inflation cycles.

-

Stocks represent ownership in businesses that can raise prices and grow profits — a natural hedge against inflation.

-

Stocks are traded globally, often within milliseconds. Unlike real estate or private investments, your capital isn’t locked away.

-

Public companies are required to report earnings, disclose risks, and be accountable to shareholders.

-

Whether it's AI, green energy, or biotechnology, the most innovative sectors of the future are accessible first through equities.

When We Act

Timing the market? No. Understanding the market? Absolutely.

The stock market is a living, breathing system — constantly digesting information, reacting to data, and evolving in real time. That’s why we built a proprietary trading algorithm that helps us decide when to buy, sell, hold, or wait. It doesn’t guess. It listens. It analyzes. It adapts. Every stock we trade is monitored daily through a lens of historical price volatility and real-time data to ensure our timing is rooted in reason — not emotion.

Our proprietary algorithm isn’t trying to beat the market with risky bets. Instead, it’s built to intelligently time decisions based on a stock’s behavior over time.

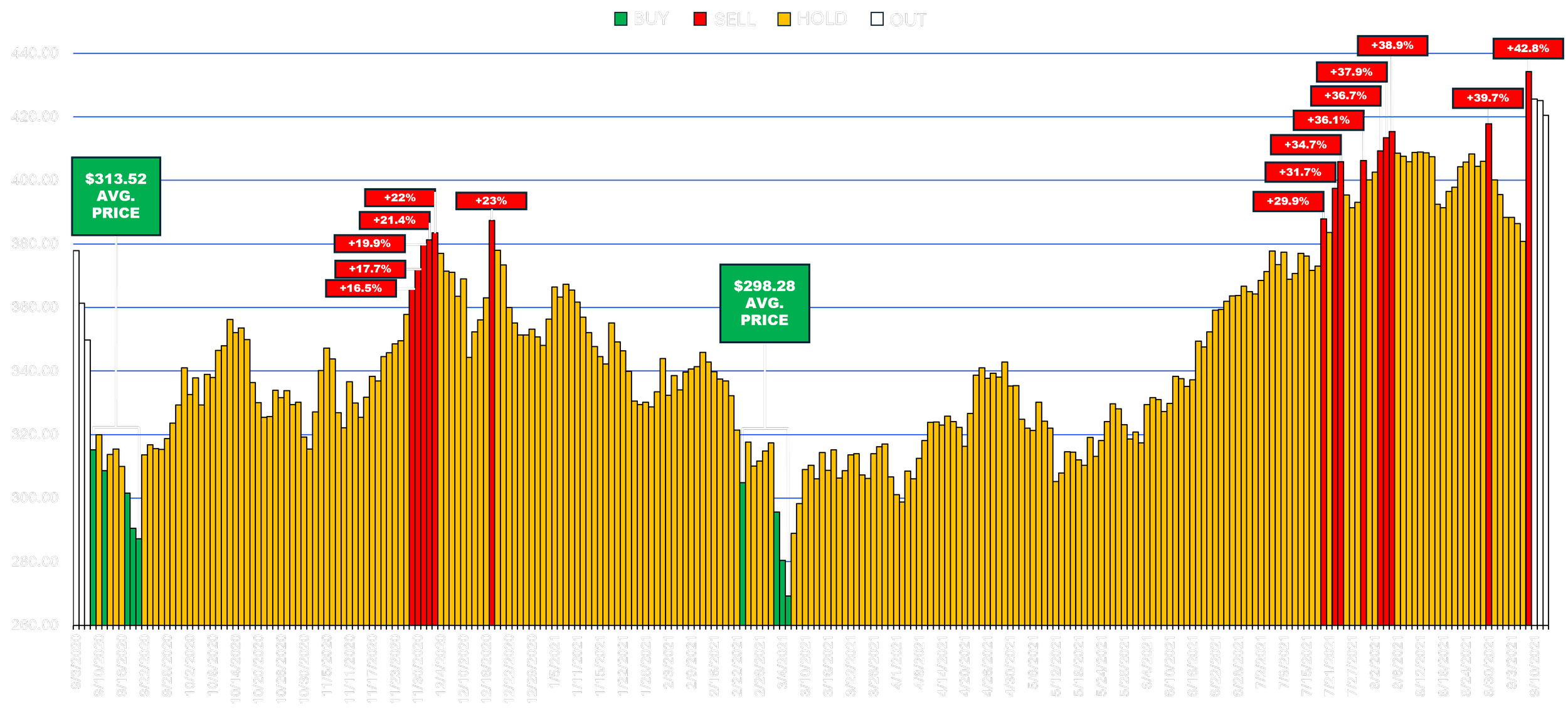

Timing in Action: The Magnificent Seven vs. COVID Volatility

Before the COVID crash, our algorithm was already signaling risk. During the rebound, it signaled opportunity. This chart tracks the trading behavior for the seven largest U.S. tech stocks — compared to the S&P 500 — six months before and after the crash. It’s a window into how our system thinks, and why timing matters.

—

-

Markets move fast — and rarely in straight lines. Our proprietary algorithm analyzes every equity we trade daily, comparing real-time movements to decades of historical data. This gives us an edge in identifying early signs of momentum or risk before they show up in the headlines.

-

Sometimes the best position is no position. When volatility spikes or momentum breaks down, our system has the discipline to move to cash or reduce exposure. This isn’t guesswork — it’s data-driven confidence. Unlike pooled funds, we aren’t forced to stay fully invested at all times.

-

Whether it’s a pandemic, geopolitical conflict, or policy shift in a foreign market, our system reacts in real time. We track volatility across every major exchange and every security in our universe to ensure we respond to risk and opportunity as it happens — not weeks or months later.

-

Our system isn’t just reacting to headlines — it’s reading price action at both a market-wide and individual equity level. If the macro environment is signaling risk, but a specific stock is showing strength, we know how to separate signal from noise and act accordingly.

-

In early 2020, our system began reducing positions in major names well before the crash. As the market bottomed, it signaled selective re-entry — long before sentiment turned bullish again. This approach helped us avoid unnecessary losses while positioning for the rebound faster than traditional strategies.

More Than Just Wall Street

Global access means global opportunity.

While many investors stick to the U.S., we expand far beyond. Companies are listed all over the world — often in places you wouldn’t expect — and knowing the right version of a company to trade is just as important as choosing the right company itself. Through our global trading infrastructure, we’re able to identify the most liquid, most efficient listing of every business we own.

One Company, Multiple Listings

A single company might be listed in multiple countries, but not all listings are created equal. For example, Shell is headquartered in the U.K., but its U.S.-listed ADR has better liquidity and trading efficiency. Knowing which listing offers the best exposure is critical for execution, performance, and cost.

—

-

Some markets, like China’s mainland exchanges (Shanghai and Shenzhen), are limited in access and capital flow. Instead, we seek exposure via Hong Kong, which offers more favorable terms for foreign investors. These are nuanced decisions that make a huge difference in execution.

-

Trading volume and spread can vary dramatically by exchange. For example, buying a major stock on a local exchange might introduce higher costs, wider bid-ask spreads, and lower liquidity. We prioritize trading where liquidity is strongest to ensure efficiency and flexibility.

-

From Tokyo to Toronto, we trade directly on the world’s top exchanges. Our systems constantly assess market health and liquidity across borders, ensuring your portfolio remains nimble and optimized, no matter where the opportunity lies.

-

Our process breaks down the global index — not just by country, but by where and how we get exposure. That means owning companies in the best place to own them — whether that’s via U.S. listings, ADRs, or local shares in developed and emerging markets.

Why We Invest This Way

Tailored. Transparent. Transformational.

The traditional model of pooled funds and broad mutual strategies strips away the nuance of you. We believe your portfolio should reflect your goals, risk tolerance, tax needs, and even your personal values. Our separately managed accounts (SMAs) are built to do just that — combining the power of global markets with hyper-personalized execution. This isn’t mass investing. This is your portfolio, your way.

Goodbye Pooled Funded, Hello Personalization

Most investment firms lump you into a pre-built fund where your preferences are lost. Our SMA structure means each client has a dedicated portfolio, built and managed specifically for them — no dilution, no generalization, just clarity and control.

—

-

Whether it's avoiding certain industries or aligning with ESG standards, your values can be reflected directly in what you own. SMAs allow us to exclude or include companies based on your personal beliefs — a flexibility pooled funds simply don’t offer.

-

Everyone’s tax situation is different. With SMAs, we can defer gains and structure trades with your personal tax picture in mind. That’s impossible with traditional pooled vehicles.

-

From conservative to aggressive, every portfolio is risk-profiled at the individual level. That means your portfolio won’t swing like someone else’s — it’s designed around your comfort zone, not the average.

-

Houndstooth brings institutional-grade global access to individuals, no matter their account size. Thanks to modern technology, we can offer the kind of diversified, actively managed, cross-border investing that used to be reserved for the ultra-wealthy.

How We Make the Call

Real-time intelligence meets historical precision.

Our proprietary algorithm doesn’t just react — it anticipates. Every stock we touch is continuously evaluated against its own historical data, global market volatility, and live macro conditions. The result? Timely, personalized decisions that go beyond traditional models.

Real Life Trade Example

This position started with a long-term view, but volatility gave us the chance to improve it. We added to the position five times over the course of a year, lowering our average price and increasing our conviction. Within just a few months, we sold a portion of the trade for a strong gain, while continuing to hold the rest. By staying patient and strategic, we were able to ride the trend and exit with confidence

—

-

We analyze every trading day in a stock's life, comparing patterns, momentum shifts, and volatility signatures to spot statistically significant signals.

-

Our system ingests real-time price action, volume, and macroeconomic data to know exactly when it’s time to act — or sit tight.

-

Every signal goes through a filter based on your specific tax strategy, risk tolerance, and moral preferences before a trade is made.

-

Our algorithm knows where to find the most liquid, efficient version of a stock — even if that means trading in Hong Kong instead of Shanghai.

-

As markets evolve, so does our algorithm. It adapts with new data, market regimes, and trends, always staying one step ahead.

Let’s Build Your Portfolio Together.

We handle every aspect of your investment strategy. Let’s discuss your financial goals and how we can help you achieve them.