See Real Strategy.

Study Every Move.

Seoul, South Korea

Short-Term Trade

This NVIDIA trade highlights how tactical buying and efficient scaling can maximize returns in a short time frame.

We averaged down through three buying opportunities over just ten days, then patiently held for about a month before scaling out for profits between 20.4% and 38.6%.

—

Key Takeaways:

Averaging down during short-term price weakness set up a stronger cost basis.

Scaling out during the uptrend locked in profits across multiple price points.

Patient buying and strategic selling helped maximize the overall trade return.

—

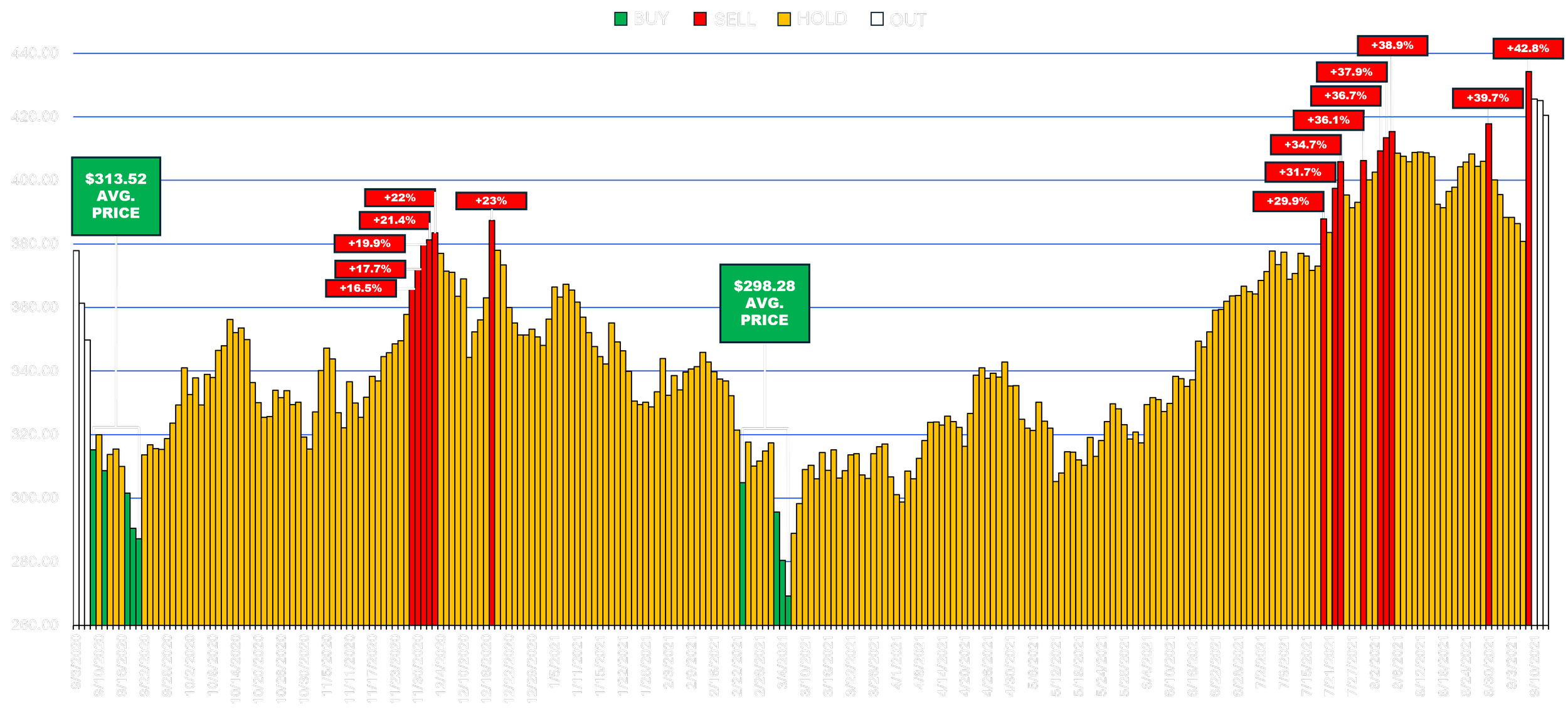

Mid-Term Trade

Our Lululemon position shows the power of patient mid-term investing.

After building an initial position and lowering our cost basis across five buying opportunities, we strategically held and scaled out over several months — ultimately realizing profits ranging from 16.5% up to 42.8%.

—

Key Takeaways:

Active management allowed lowering cost basis through smart averaging.

Patience during market noise resulted in significant profit expansion.

Multiple sell points captured incremental gains while protecting gains on remaining shares.

—

Long-Term Trade

The JPMorgan Chase trade demonstrates active long-term portfolio management across multiple years.

By combining strategic accumulation, patient holding, and multiple profit-taking windows, we maximized returns through evolving market cycles — achieving profits from 10% on initial trades up to 48.4% on longer-term holdings, while efficiently re-entering when new opportunities appeared.

—

Key Takeaways:

Active management allows weaving in and out of positions based on opportunity.

Patient holding periods + smart accumulation allowed deep cost basis reductions.

Profit was captured both during strong upswings and through disciplined re-entries after pullbacks.

—

Mag 7: COVID Trading

This trade study highlights how the "Magnificent Seven" stocks behaved around the COVID-19 market crash — tracking their performance six months before and six months after the March 2020 bottom. While the entire market was affected by the macro event, each company reacted differently in both timing and magnitude. By layering the S&P 500 as a benchmark, the graphic reveals the divergence in price action and recovery speeds, proving that even in a global crisis, individual fundamentals still lead the way. Active management remains critical, especially when navigating volatility with conviction on a company-by-company basis.

Individual Macro Volatility:

—

Key Takeaways:

Macro doesn’t erase micro. Company-specific fundamentals still matter — even during black swan events.

Not all leaders are equal. Even among the Mag 7, recovery timelines varied drastically.

Active management wins. Buying and selling decisions must be made based on each business, not just the market as a whole.

Correlation breaks under pressure. Major events reveal which stocks are truly resilient and which are passengers.

Risk isn’t one-size-fits-all. Diversification across dominant names doesn’t guarantee uniform outcomes.

—

Let’s Build Your Portfolio Together.

We handle every aspect of your investment strategy. Let’s discuss your financial goals and how we can help you achieve them.